merced county tax collector online

209-385-7307 Tax Collector Phone. 209 385-7434 Email Us.

View Or Pay Taxes Online Merced County Ca Official Website

209-385-7690 Enterprise System Catalog.

. Treasurer Tax Collector Department page. The first installment is due and payable on November 1. Merced County 2222 M Street Merced CA 95340 Phone.

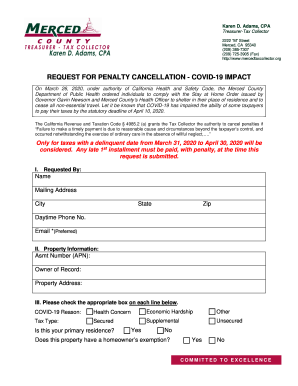

Merced County Public Records. The County Tax Collector is an elected official governed by the Revenue and Taxation Code and is responsible for the billing and collection of. Emergency Rental Utility.

209-385-7307 Tax Collector Phone. The January 1 value established by the Merced County Assessor is multiplied by the tax rate usually 1 plus voter approved indebtedness then special assessments are added. If you pay your taxes on-line or by phone a convenience fee is charged in addition to the property tax amount.

The January 1 value established by the Merced County Assessor is multiplied by the tax rate usually 1 plus voter approved indebtedness then special assessments are added. The County Tax Collector is an elected official governed by the Revenue and Taxation Code and is responsible for the billing and collection of all real and personal property taxes. Please note that for Merced County all.

There are 2 Treasurer Tax Collector Offices in Merced County California serving a population of 267390 people in an area of 1935 square milesThere is 1 Treasurer Tax Collector Office. 800am - 430pm Closed Weekends Holidays. Merced County Tax Collector 209 385-7592.

Learn more about paying property taxes online HERE. 209-385-7307 Tax Collector Phone. However you have until 5 pm.

Mail your check and payment stub to 2222 M St Merced CA 95340. As always we encourage you to pay your property taxes online by automated phone system or by mail. NETR Online Merced Merced Public Records Search Merced Records Merced Property Tax California Property Search California Assessor.

The Merced County Secured property tax bill is payable in two installments. The County Tax Collector is an elected official governed by the Revenue and Taxation Code and is responsible for the billing and collection of all real and personal property. Pay county taxes and fees including permit and project fees library fines and property taxes.

California Department of Housing and. Credit Card 234 of paid taxes 200 minimum fee Debit Card 395 flat fee. A single 2500 deposit plus a 35 non-refundable processing fee is required to participate in the County of Merced Tax Sale.

Pay Online at Merced County Tax Collector. For more information read e-Bill frequently asked questions below. On December 10 to make.

Merced County Treasurer - Tax Collector. Merced County Treasurer - Tax Collector. E-check via online or phone are free.

Postmark on or before the stated due date to avoid penalty. County of Merced 2222 M Street Merced CA 95340 Phone.

Pinellas County Tax Collector Mid County 19 Reviews 13025 Starkey Rd Largo Fl Yelp

2456 Glen Ave Merced Ca 95340 Mls Pw22108009 Redfin

1221 H St Merced Ca 95341 Mls Ml81889921 Zillow

Cities And Towns Across California Get Only The Libraries They Can Afford Jefferson Public Radio

New Program Allows Taxpayers Pay Annual Property Taxes In Monthly Installments County Of San Luis Obispo

The U S Is Losing 1 Trillion Annually To Tax Cheats The New York Times

Property Taxes Department Of Tax And Collections County Of Santa Clara

Merced County Treasurer Tax Collector Merced Ca

Merced County California Genealogy Familysearch

View Or Pay Taxes Online Merced County Ca Official Website

593 Barcelona Ct Merced Ca 95341 Realtor Com

Levey Leaves Legacy Of Strengthening County Offices Merced County Times

Home Page Benton County Oregon

Fillable Online Secure Property Tax April 10 Deadline Merced County Times Fax Email Print Pdffiller

)/Merced/WebInquiry/Images/PublicTax.jpg)